Los Angeles is a sprawling concrete jungle whose identity is tied to its numerous freeways and surface streets and the thousands of cars that traverse them daily. With its high motor vehicle volume, it is no surprise that Los Angeles has some of the highest car insurance rates of any U.S. city. Drivers in the City of Angels often face steep premiums that are dictated by one critical piece of information: their residential ZIP code.

Understanding which ZIP codes carry the highest car insurance costs in Los Angeles is essential for anyone who drives here or is planning to move. This guide reveals where rates are the highest, why those areas top the list, and how it all ties back to accident statistics, population density, and local economic conditions. It also offers insight into what you can do to protect your legal rights if you are affected by these rising costs.

Whether you are comparing rates or just curious about how your neighborhood stacks up, knowing the highest ZIP codes for car insurance in Los Angeles can help you make smarter financial and legal decisions.

Why Your ZIP Code Impacts Car Insurance Rates

In Los Angeles, where you live can play as large a role in your car insurance premium as your driving history. Insurance companies use ZIP codes to assess risk, which means two drivers with identical records may pay drastically different rates based on their location.

For example, residents of neighborhoods like South Central or East Hollywood often pay more than those in areas like Brentwood or Sherman Oaks. These price differences are tied to factors such as accident frequency, claims history, crime rates, and even the cost of repairs in a given ZIP code. That is why understanding both the highest and best ZIP codes for car insurance is more than just trivia, it is a way to stay informed about your financial liabilities as a driver.

What is a ZIP Code in Car Insurance?

In the world of car insurance underwriting, a ZIP code is more than just a postal identifier. It is a powerful tool that insurers use to evaluate geographic risk.

Insurance companies collect and analyze data tied to ZIP codes, including traffic patterns, accident reports, theft statistics, and medical costs related to injuries. This information helps them set premiums that reflect the unique risks associated with each area.

When insurers calculate your rate, they consider where the vehicle is primarily parked or driven. This means your home address, down to the exact ZIP code, can determine whether you pay significantly more or less than someone just a few miles away.

Understanding what a ZIP code means for car insurance can help consumers ask the right questions and advocate for themselves when reviewing or disputing their premiums.

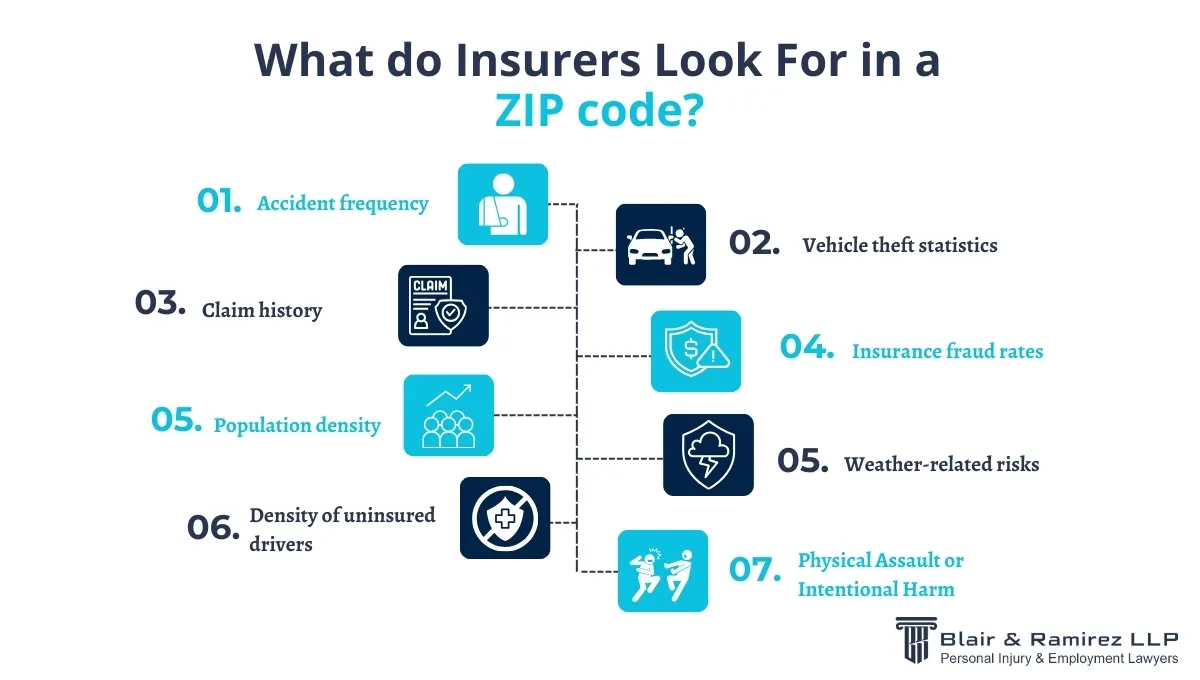

What do Insurers Look for in a ZIP Code?

When determining insurance rates, insurers analyze specific factors tied to a ZIP code. These geographic markers help them build a ‘risk profile’ for the area, which directly influences policy pricing and coverage decisions. Here are the primary metrics insurers evaluate:

- Accident frequency

Insurers examine how often accidents occur in a particular ZIP code. A high number of reported collisions may suggest risky driving conditions or traffic congestion, which can raise premiums. - Vehicle theft statistics

Areas with elevated rates of auto theft are seen as higher risk. Insurers factor in how frequently vehicles are stolen in the ZIP code to assess the likelihood of future claims. - Claim history

A ZIP code with a large volume of past claims signals a higher probability of future incidents. This includes not only accidents but also comprehensive claims such as vandalism or weather-related damage. - Insurance fraud rates

Fraudulent claims inflate costs for insurers. ZIP codes with a documented history of insurance fraud are flagged as higher risk, resulting in increased premiums for all drivers in that area. - Population density

Denser areas typically mean more vehicles on the road, leading to a greater chance of accidents. High traffic volumes, limited parking, and urban congestion contribute to elevated risk levels. - Weather-related risks

ZIP codes that are prone to severe weather events, such as flooding, hailstorms, or hurricanes, are seen as high-risk. These natural hazards increase the chance of damage-related claims. - Density of uninsured drivers

Insurers consider how many drivers in the area are uninsured. A high percentage of uninsured motorists can elevate the financial risk for insured drivers, particularly in the event of a collision involving an at-fault party without coverage.Each of these factors helps insurers craft a detailed risk assessment for a ZIP code, guiding how they price and underwrite auto insurance policies within that region.

Why ZIP Code Plays a Bigger Role in Cities Like Los Angeles

In a sprawling metropolis like Los Angeles, ZIP codes carry extra weight in determining auto insurance rates. This is because the city is made up of a patchwork of micro-neighborhoods, each with its own unique risk profile. Even moving a few blocks can lead to a premium change of several hundred to over a thousand dollars. Here is why ZIP code is essential in a city like Los Angeles:

- Micro-neighborhood variation

Los Angeles neighborhoods can differ drastically in terms of safety, traffic conditions, and accident history. A ZIP code just a short distance away may have significantly more thefts, accidents, or claims, which drives up the cost of insurance. - Proximity to major highways

Areas near freeways and major roads often experience higher traffic volume and accident frequency. Living close to a highway can increase your risk exposure, especially during peak commuting hours. - Population density and urban layout

Los Angeles is one of the most densely populated cities in the country. Tightly packed neighborhoods with limited space increase the likelihood of minor accidents and fender benders. Narrow streets and closely parked vehicles also raise the chances of damage. - Localized traffic conditions

Some ZIP codes are known for heavy congestion, poorly timed traffic lights, or confusing intersections. These factors can make driving riskier and lead to more claims being filed. - Street parking and vehicle exposure

In many LA neighborhoods like Santa Monica, Venice, and Hermosa Beach, residents rely on street parking, which exposes vehicles to a higher risk of damage, theft, and vandalism. Areas without secure garages or driveways often see higher rates. - Cost of repairs

ZIP codes with higher living costs usually come with more expensive repair services. Labor and parts tend to cost more in affluent or central areas, which insurers factor into their pricing. - Accident hotspots and traffic volume

Certain intersections or roadways in Los Angeles are known for frequent collisions. ZIP codes containing or bordering these high-risk zones are priced accordingly by insurers.

In a diverse and expansive city like Los Angeles, ZIP codes do more than identify a location, they shape how insurers assess the likelihood and cost of future claims. This makes ZIP code a central element in how rates are sent for local drivers.

Top 12 Highest ZIP Codes for Car Insurance in Los Angeles

The following table presents the top 12 ZIP codes in Los Angeles with the highest average annual car insurance premiums:

| Rank | Zip Code | Neighborhoods | Average Annual Premium |

|---|---|---|---|

| 1 | 90010 | Koreatown/Mid-Wilshire | $3,471 |

| 2 | 90028 | Hollywood | $3,433 |

| 3 | 90004 | Hancock Park | $3,417 |

| 4 | 90038 | East Hollywood | $3,415 |

| 5 | 90021 | Arts District | $3,390 |

| 6 | 90062 | Vermont Square | $3,383 |

| 7 | 90020 | Koreatown | $3,372 |

| 8 | 90046 | Hollywood Hills/Fairfax | $3,369 |

| 9 | 90008 | Koreatown | $3,367 |

| 10 | 90018 | Hollywood Hills/Fairfax | $3,362 |

| 11 | 91342 | Baldwin Hills/Leimert Park | $2,396 |

| 12 | 93535 | Jefferson Park/West Adams | $2,045 |

These ZIP codes consistently rank among the highest in Los Angeles due to several contributing factors:

- High Accident and Claim Frequency: Areas like Koreatown and Downtown LA experience dense traffic from early morning to late evening, leading to a higher number of car accidents and subsequent car accident insurance claims.

- Elevated Theft and Vandalism Rates: Neighborhoods such as Hollywood and East Hollywood have higher incidences of vehicle theft and vandalism, increasing the risk for insurers.

- Urban Density and Congestion: High population density and limited parking in areas like Mid-Wilshire and Century City contribute to more frequent minor accidents and claims.

Drivers residing in these ZIP codes may face insurance premiums that are 30–50% higher than those in less risky areas. Additionally, they might encounter higher deductibles and an increased likelihood of being involved in an accident, reflecting the elevated risk profile associated with these regions.

What These ZIP Codes Have in Common

High-cost ZIP codes for car insurance in Los Angeles share a set of common traits that make them riskier for insurers. These areas are often densely populated, experience significant daily traffic volume, and present driving conditions that increase the likelihood of accidents and claims. Understanding these shared characteristics helps explain why premiums are consistently higher in neighborhoods like Koreatown, Downtown LA, and Hollywood.

Urban Traffic and Congestion

One of the most defining features of these ZIP codes is the heavy urban traffic and near-constant congestion. Data shows that drivers in areas like Downtown Los Angeles and Hollywood face some of the longest commute times in the city, often exceeding 45 minutes each way. This extended time on the road increases driver fatigue and impatience, both of which raise the chance of an accident.

Stop-and-go driving, which is common on streets like Sunset Boulevard or Wilshire Boulevard and freeways like the 101 Freeway and Interstate 10 during rush hour, puts constant pressure on brakes, reaction times, and driver awareness. It also leads to a higher frequency of low-speed collisions such as fender benders and rear-end crashes. These minor accidents might not be life-threatening, but they generate frequent insurance claims that drive up premiums. In such neighborhoods, the daily driving experience is not just inconvenient, it is statistically more dangerous, making them more expensive ZIP codes for car insurance.

High Density of Drivers

Los Angeles ZIP codes with high car insurance premiums, such as 90004, 90005, and 90029, have a large concentration of registered vehicles. More drivers on the road lead to more interactions, which naturally increases the frequency of accidents and insurance claims. Parking scarcity exacerbates this, with motorists in neighborhoods like Koreatown often parking in tight spaces or on crowded side streets, resulting in side-swipe incidents or minor collisions.

Additionally, proving fault in urban collisions is more legally complex. With numerous drivers, pedestrians, and limited visibility, liability can be unclear, making claims harder to settle. This combination of dense traffic, scarce parking, and complicated fault determination drives up both the frequency and cost of claims in these areas.

Greater Risk of Collisions and Claims

Historical claims data by ZIP code shows that areas with high car insurance premiums, such as Koreatown and Downtown LA, consistently experience a higher volume of both property damage and injury claims. The severity and cost of these claims are also elevated in these neighborhoods. High traffic, frequent congestion, and complex driving conditions increase the likelihood of accidents, leading to higher overall claim payouts.

These areas see a significant number of property damage claims, from fender benders to more serious collisions, as well as injury claims, due to the high risk of accidents in dense urban environments. Even drivers who are not at fault in these neighborhoods are affected by the behavior of others, such as reckless or distracted driving. No-fault drivers may find their premiums rising due to the general level of risk in the area, with increased claims from neighboring drivers impacting the cost of insurance for everyone.

Local Repair and Medical Costs

In high-cost ZIP codes like Koreatown or Hollywood, premiums reflect not only the risk of accidents but also the high cost of repairs and medical services in the area. Auto body shops in these neighborhoods charge higher rates due to elevated labor costs, expensive parts, and the need for specialized services to handle the complex damage typical of urban collisions. Insurers factor in these local repair costs when setting premiums, which contributes to the higher rates in these regions.

Similarly, medical expenses in densely populated areas tend to be higher due to the cost of hospital services and healthcare providers in the city. Personal injury claims are affected by these local economic conditions, where the cost of treatment and recovery can escalate. These economic damages, which refer to financial losses like medical bills, lost wages, and rehabilitation costs, can significantly raise the overall cost of claims. As a result, drivers in high-risk ZIP codes face higher premiums not just for the likelihood of accidents, but also for the higher costs associated with both repairing their vehicles and treating injuries.

Tips to Lower Your Car Insurance Premium

Living in a high-risk ZIP code in Los Angeles does not mean you are doomed to pay sky-high car insurance premiums. While your location certainly plays a role in determining your rates, there are several practical steps you can take to lower your premiums without sacrificing coverage.

From adjusting your coverage options to exploring discounts, these strategies can help you manage your costs, even if you live in one of the highest ZIP codes for car insurance. Here are some proven tips to reduce your premium while maintaining the protection you need.

Increase Your Deductible

- What is a deductible?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in to cover the remaining costs after an accident or damage. - How increasing it lowers costs:

By increasing your deductible, you lower your monthly premium, as you are agreeing to pay more upfront in case of a claim. - Trade-off:

While this can reduce your premiums, it does carry a risk. If an accident happens, you will have to pay more out of pocket before insurance coverage applies. - Risk vs reward:

Increasing the deductible offers immediate savings on your premium, but the trade-off is that you will pay more in the event of a claim.

Bundle Auto with Home/Renters Insurance

- Multi-policy discounts:

Bundling your auto insurance with your homeowners or renters insurance can provide significant discounts. Insurers reward customers who consolidate policies by offering lower rates. - California insurers:

Major insurers in California like State Farm, Geico, Progressive, and Allstate, offer these bundle packages, allowing you to save money on both policies. - Best deals:

It is important to shop around and find insurance carriers offering the best bundle deals, as discounts can vary by insurer.

Use Telematics or Usage-Based Insurance

- What is telematics?

Telematics or usage-based insurance involves tracking a driver’s behavior through a device or smartphone app. Insurers monitor things like speed, braking patterns, and miles driven. - Savings for low-risk drivers:

If you are a low-risk driver (e.g., safe driving habits, low mileage), you can earn discounts based on how well you drive. - Legal leverage:

Telematics data can also play a role in future disputes. It provides clear evidence of driving behavior, which could potentially be used as legal leverage in the event of an accident or claim dispute.

Maintain a Clean Driving Record and Good Credit

- Tracking over time:

Insurers track your driving behavior over time, including any accidents, violations, or claims, which can significantly affect your premium. - Credit-based insurance scores:

Insurers also use credit scores as part of their pricing model. Maintaining good credit can help you secure lower premiums, as a higher credit score is often associated with lower insurance risk.

Compare Quotes Frequently

- Rate shopping is legal and free:

Shopping around for the best insurance quotes is completely legal, and free and often leads to significant savings. Many drivers do not realize that rates can fluctuate, and switching insurers can save money. - Check annually:

It is a good practice to compare quotes annually, especially after a claim or major change in your life (like moving or buying a new vehicle). This helps ensure you are still getting the best rate for your needs.

Frequently Asked Questions

Concerned About Rising Insurance Rates After an Accident? We Can Help.

At Blair & Ramirez LLP, we understand the stress of dealing with rising insurance rates after an accident. Our experienced LA auto accident attorneys are here to fight for your financial recovery, ensuring you get the compensation you deserve while protecting your interests. We offer a no-fee guarantee, meaning you don’t pay unless we win your case, and a free consultation to discuss your situation.

If you’re facing higher rates or complications with your auto insurance after an accident, don’t hesitate to reach out. Contact us today to get the legal help you need.

Call us now at (213) 557-6413 or contact us online for immediate assistance.